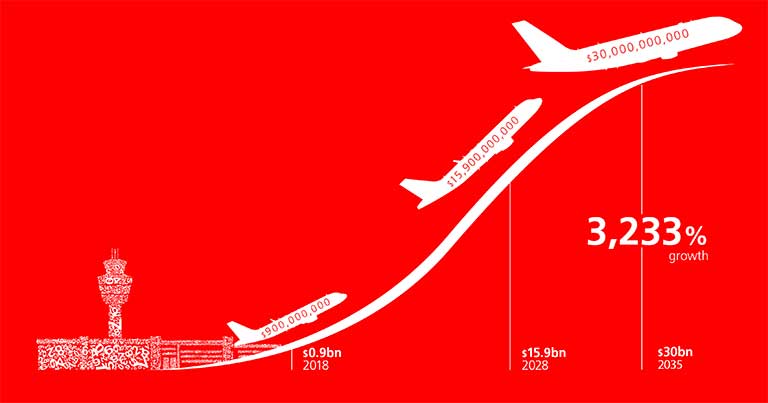

In-flight broadband has the potential to create a $130 billion global market within the next 20 years, resulting in $30 billion of additional revenue for airlines by 2035, according to a new study by London School of Economics and Political Science (LSE) in association with Inmarsat.

The study – entitled ‘Sky High Economics: Quantifying the commercial opportunities of passenger connectivity for the global airline industry’ – was released during APEX EXPO in Long Beach.

Based on current IATA data and industry sources, Sky High Economics has developed an independent forecasting model. It predicts broadband enabled ancillary revenues for airlines will come from four main revenue streams:

- Broadband access charges – providing connectivity to passengers in-flight;

- E-commerce and destination shopping – making purchases onboard aircraft with expanded product ranges and real-time offers;

- Advertising – pay-per-click, impressions, sponsorship deals with advertisers;

- Premium content – providing live content, on demand video and bundled W-IFEC access.

According to the study, at present only 53 airlines worldwide offer in-flight broadband connectivity. It also states that on the back of strong passenger demand, in-flight internet will be ubiquitous on commercial aircraft by 2035. Currently, airlines receive an additional $17 per passenger from ‘traditional’ ancillary services such as duty free purchases and in-flight retail, food and drink sales. Broadband-enabled ancillary revenues will add an extra $4 by 2035.

It is forecasted that by 2035, airlines will generate $15.9 billion from broadband access charges, $6.8 billion from broadband-enabled e-commerce, $6 billion from broadband-enabled advertising, and $1.4 billion from broadband-enabled premium content.

Drivers for growth

Full service carriers look set to claim the lion’s share of airline revenues (63%), generating $19 billion by 2035. Capitalising on longer flight times, additional revenue will come from the ability to maximise e-commerce platforms and striking deals with content providers to offer premium packages. The Sky High Economics study predicts low cost carriers will generate $11 billion by 2035, the bulk of which will come from selling connectivity to passengers.

The research also identified that regionally, the greatest opportunity for broadband-enabled ancillary services is in Asia Pacific. Driven by passenger growth and availability of services, airlines in Asia Pacific will benefit from $10.3 billion of ancillary revenues by 2035, followed by Europe ($8.2 billion) and North America ($7.6 billion).

Dr Alexander Grous (B. Ec, MBA, M.Com, MA, PhD.), Department of Media and Communications, LSE and author of Sky High Economics, commented: “The opportunity available to airlines is enormous. The Sky High Economics study predicts the creation of a $130 billion market within the next two decades. Globally, if airlines can provide a reliable broadband connection, it will be the catalyst for rolling out more creative advertising, content and e-commerce packages. We will see innovative deals struck, partnerships formed and business models fundamentally changed for new players to lay claim to the $100 billion opportunity away from airlines. Broadband-enabled ancillary revenue has the potential to shape a whole new market and it’s something airlines need to be planning for right now.”

Frederik van Essen, Senior Vice President Strategy & Business Development, Inmarsat Aviation, added: “As airlines start to act more like retailers, they will realise the benefits of closing the in-flight connectivity gap. Doing so will lead to unlocking $15 billion per year in additional ancillary revenues within the next decade, one of the biggest sources of growth. The key to this potential and getting to the eventual $30 billion revenues, is fast, high quality in-flight internet that can be relied upon without drop-outs.”